About

General Information

Located in the main street of Thomastown in the southeast of Ireland, Thomastown Credit Union has been serving the people of the town and surrounding areas since 1969, when it was first opened.

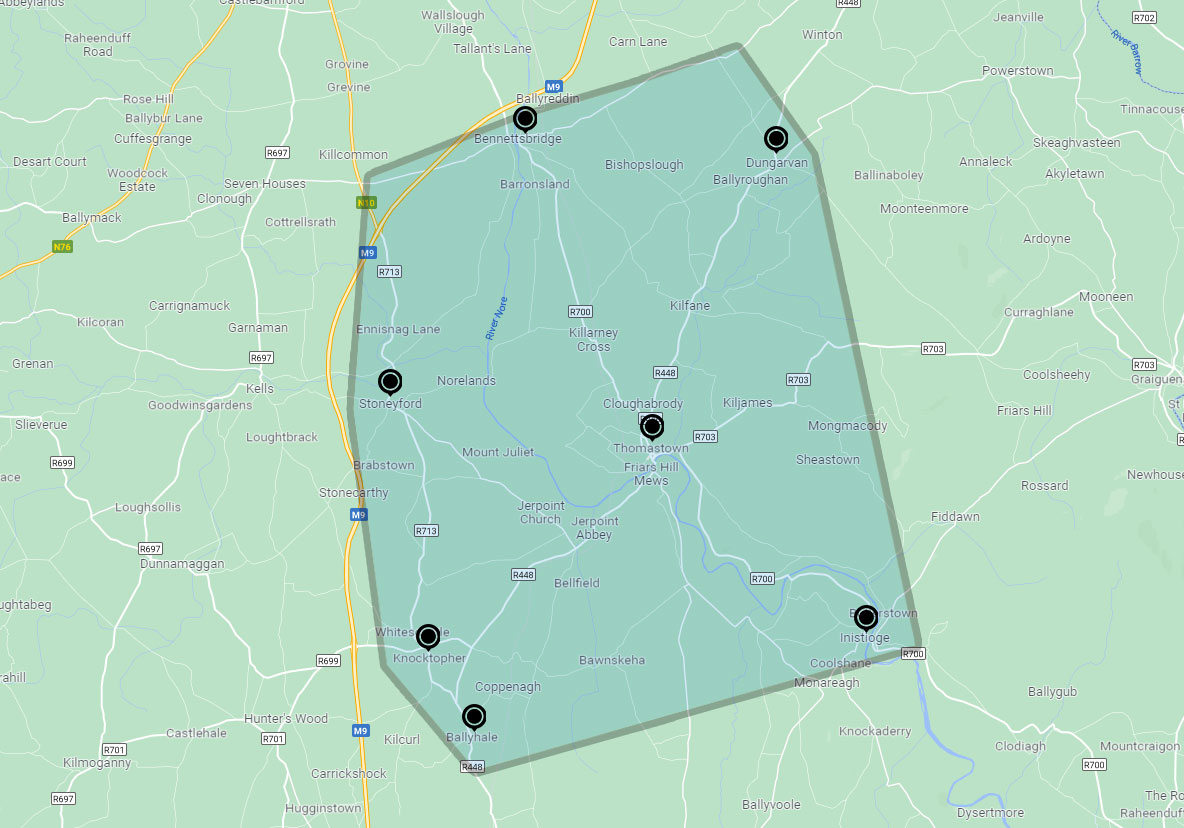

We operate two offices, Market Street, Thomastown and The Old Creamery Yard, Bennettsbridge. Membership currently stands at almost 5,500, with shares exceeding €25 million and loans of €6.5 million. The COMMON BOND includes Thomastown, Inistioge, Dungarvan, Ballyhale, Knocktopher, Stoneyford and Bennettsbridge.

History

The organisation meeting of Thomastown Credit Union was held at Grennan Hall, Marsh's Street, Thomastown on Friday, 10 January, 1969 at 20.00 hrs.

Those present were:

| Very Rev. Dr. Michael Carroll, P.P., Parochial House | Mrs. Michael Brennan, Market St. |

| Mr. and Mrs. Christopher Beck, Ladywell | Mr. and Mrs. Thomas Comber , Chapel Lane |

| Mrs. John Deloughry, Newtown Tce. | Mrs. Joseph Minogue, Newtown Tce. |

| Mr. Thomas Beck, Newtown Tce. | Mrs. Gerard Doyle, Maudlin St. |

| Mrs. William O'Reilly, Market St. | Mr. Joseph O'Reilly, Ladywell |

| Mr. Joseph Cole, The Mall | Mr. Patrick Skehan, Newtown Tce |

| Mr. Edward Ryan, Friarshill | Mr. John Cahalane, Low St. |

| Mr. Herbert Devoy, Dangan Tce | Mr. Bernard Walsh, Ladywell |

| Mr. Edward Kennedy, Abbeyview | Mr. John Laffan, Low St. |

| Mr. William Barron, Ladywell | Mr. Robert Power, Grennan View |

| Messrs. G. Murray and J. Bollard represented St. Canice's Credit Union, Kilkenny, which sponsored Thomastown Credit Union. |

Very Rev. Dr. M. Carroll took the chair and reviewed the events which had led to the registration of a Credit Union in Thomastown, paying tribute especially to the services rendered by Mrs. M. Brennan and John Laffan. Emphasising the need for a close study of the rules, he pointed out that a Credit Union is a business and that the members must thoroughly understand the business, if costly mistakes were to be avoided.

He drew attention to the word Credit in the title and hoped that the members would not be unduly bashful in availing of the credit-creating facilities of the union for unless the deposits earned interest, the Credit Union would not fulfil its true function.

He impressed on those present that the Credit Union belonged to all members, present and future and lastly he appealed to the members present to encourage other people to come into the Credit Union, especially young wage earners.

Dr. Carroll then presented a financial statement showing the state of accounts as on 1 January, 1969. Shares and entrance fees amounted to £308 -3- 0, loans outstanding totaled £97 and there were 41 active members.

On the proposition of T. Comber, seconded by Mrs. G. Doyle, the financial report was unanimously adopted. Dr. Carroll explained the election procedure and drew the members' attention to the rules governing the election of directors and members of the Supervisory committee.

As there were no nominations from the floor, Dr. Carroll proposed and Mrs. T . Comber seconded the election of the nominated directors: Dr. M. Carroll, Mrs. M. Brennan, Mrs. G. Doyle, Messrs. W. Barron, C. Beck, T. Comber and E. Ryan.

On the proposition of W. Barron, seconded by T. Comber, it was unanimously resolved that Very Rev. Dr. Carroll, John Cahalane and Edward Kennedy be elected to the Supervisory Committee.

The election of auditor was deferred until more precise information became available as to the qualifications demanded of auditors.

The meeting adjourned at 21.00 hrs.

Signed -Michael Carroll P.P.

CREDIT UNION OPERATING PRINCIPLES

Statement of Credit Union Operating Principles as adopted at Annual General Meeting of the Irish League of Credit Unions 1984.

INTRODUCTION

These Credit Union Operating Principles are founded in the philosophy of co-operation and its central values of equality, equity and mutual self-help. At the heart of these principles is the concept of human development and the brotherhood of man expressed through people working together to achieve a better life for themselves and their children.

1. OPEN AND VOLUNTARY MEMBERSHIP

Membership in a credit union is voluntary and open to all within the accepted common bond of association that can make use of its services and are willing to accept the corresponding responsibilities.

2. DEMOCRATIC CONTROL

Credit union members enjoy equal rights to vote (one member, one vote) and participate in decisions affecting the credit union, without regard to the amount of savings or deposits or the volume of business. The credit union is autonomous, within the framework of law and regulation, recognising the credit union as a co-operative enterprise serving and controlled by its members. Credit union elected officers are voluntary in nature and incumbents should not receive a salary for fulfilling the duties for which they were elected. However, credit unions may reimburse legitimate expenses incurred by elected officials.

3. LIMITED DIVIDENDS ON EQUITY CAPITAL

Permanent equity capital where it exists in the credit union receives limited dividends.

4. RETURN ON SAVINGS AND DEPOSITS

To encourage thrift through savings and thus to provide loans and other member services, a fair rate of interest is paid on savings and deposits, within the capability of the credit union.

5. RETURN OF SURPLUS TO MEMBERS

The surplus arising out of the operations of the credit union after ensuring appropriate reserve levels and after payment of dividends belongs to and benefits all members with no member or group of members benefiting to the detriment of others. This surplus may be distributed among the members in proportion to their transactions with the credit union (interest or patronage refunds) or directed to improved or additional services required by the members.

Expenditure in credit unions should be for the benefit of all members with no member or group of members benefiting to the detriment of other.

6. NON-DISCRIMINATION IN RACE, RELIGION AND POLITICS

Credit unions are non-discriminatory in relation to race, nationality, sex, religion and politics within the limits of their legal common bond. Operating decisions and the conduct of business are based on member needs, economic factors and sound management principles. While credit unions are apolitical and will not become aligned with partisan political interests, this does not prevent or restrict them from making such political representations as are necessary to defend and promote the collective interests of credit unions and their members.

7. SERVICE TO MEMBERS

Credit union services are directed towards improving the economic and social well-being of all members whose needs shall be a permanent and paramount consideration rather than towards the maximising of surpluses.

8. ON-GOING EDUCATION

Credit unions actively promote the education of their members, officers and employees, along with the public in general, in the economic, social, democratic and mutual self-help principles of credit unions. The promotion of thrift and the wise use of credit, as well as education on the rights and responsibilities of members are essential to the dual social and economic character of credit unions in serving member needs.

9. CO-OPERATION AMONG CO-OPERATIVES

In keeping with their philosophy and the pooling practices of co-operatives, credit unions within their capability actively co-operate with other credit unions, co-operatives and their associations at local, national and international levels in order to best serve the interests of their members and their community. This inter-co-operation fosters the development of the co-operative sector in society.

10. SOCIAL RESPONSIBILITY

Continuing the ideals and beliefs of co-operative pioneers, credit unions seek to bring about human and social development. Their vision of social justice extends both to the individual members and to the larger community in which they work and reside. The credit union ideal is to extend service to all who need and can use it. Every person is either a member or a potential member and appropriately part of the credit union sphere of interest and concern. Decisions should be taken with full regard for the interests of the broader community within which the credit union and its members reside.